Dick Smith LIVE: Former Myer Chairman Questioned Over Dick Smith Collapse

Bill Wavish, a former director of Dick Smith, has been called before the NSW Supreme Court to answer questions about obsolescence provisioning at the collapsed retailer.

Wavish had served as a non-executive director, as well as on the Finance and Audit Committee. Barristers began by questioning him about obsolescence provisioning, and he agreed that provisions were important to make sure of accurate accounting and to aid in the clearance of old stock.

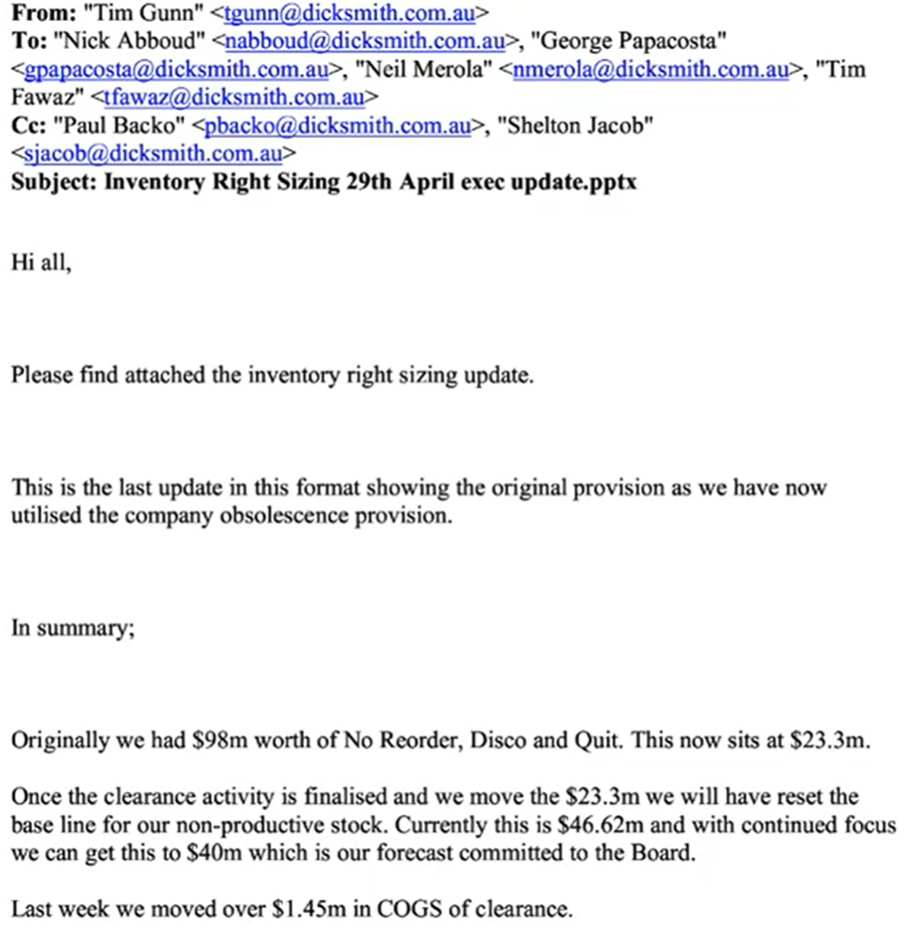

Wavish was shown an email forwarded from former CEO Nick Abboud to himself in April 2013 regarding obsolescence provisioning.

Wavish said he did not recall receiving the email or reviewing it for evidence. Barristers pointed to a reduction from $98m in No Reorder, Discontinued, and Quit stock to $23.3m. He did not recall the specific categories Woolworths had used, but said the right-sizing was made in order to clear a huge overstock of “heritage stock” from Woolworths. He said Abboud had done a good job of getting rid of it, and in fact cleared all of it. Wavish insisted he did not recall the email, but was shown a paragraph from his own affidavit relating to it.

He conceded he had probably forgotten the email was mentioned in his affidavit, and said he did not see the importance of it as the subject had not been a source of great concern for him. He was asked why he remembered the email at the time of the affidavit but not when giving evidence, and he said he was 72 years old and couldn’t remember everything, particularly in areas that had not been of concern to him. He was asked if seeing his affidavit refreshed his recollection of receiving the email, and he said it did not. He conceded it was likely he had read the email at the time he received it, and added that the stock from Woolworths was cleared by December of that year despite not having been asked. Barristers told him to answer only the questions he was asked.

He told the court he thought that the Woolworths obsolescence provision would be fully used to clear the “heritage” or “legacy” Woolworths stock.

Wavish complained to the judge that he was having trouble understanding the barrister Peter Brereton’s questions, as they were long, and asked if he could add information for context. The judge told him to focus on answering the questions without “giving speeches” or information not responsive to them.

Brereton asked about “resetting the baseline” for non-productive stock as mentioned in the email, and he said he believed it referred to non-productive non-“heritage” stock. He was asked if he recalled a forecast of $40m being committed to the Board, and he said no. He was asked if he believed Gunn in the email was committing to holding $40m in non-productive stock, excluding the Woolworths stock, and he said yes. Barristers then asked if it would be necessary to book an obsolescence provision for that stock, and he said yes.

Barristers put it to him that he believed it was important at the time for Dick Smith to clear aged stock, as well as stock that was slow-moving or inactive, and he agreed. He also acknowledged that discounts were necessary to move that stock, even below cost – but asked what the connection was to the obsolescence provision. He was asked if the obsolescence provision could be drawn upon to preserve profit margins if stock was sold below cost, but he said stock sold below cost would be charged to gross profit.

Barristers pointed in the email to “utilising the company obsolescence provision”, which he said was not a phrase he would use. Wavish said that stock losses were charged against the company’s accounts rather than the provision.

He was asked why Dick Smith needed to clear aged, poor quality, or slow-moving stock, and he said it was because the quality of inventory would get worse and greater discounts would probably be needed to clear it.

It was put to him that if Dick Smith was holding such bad stock, it would make it difficult to acquire new, good, fast-moving stock, which could impact profitability, to which he agreed. He also acknowledged that having the correct obsolescence provision would aid stock clearance, and incorrect provision would hinder it. If the provision was too small, it would hinder stock clearance, he agreed. He said he had believed it was important for Dick Smith to keep stock on hand “lean”. Barristers put it to him that if this was not the case, Dick Smith would risk holding too much stock that it could not sell profitably. He said lean stock meant fresher stock and therefore a better customer response. He also said that too much or too little stock would tie up capital that could be deployed more profitably. He agreed that having too much stock would increase warehousing costs if they could not be passed on to the supplier, and that having too much stock would inhibit profitability.

He was then shown another email from himself to Abboud, which he recognised.

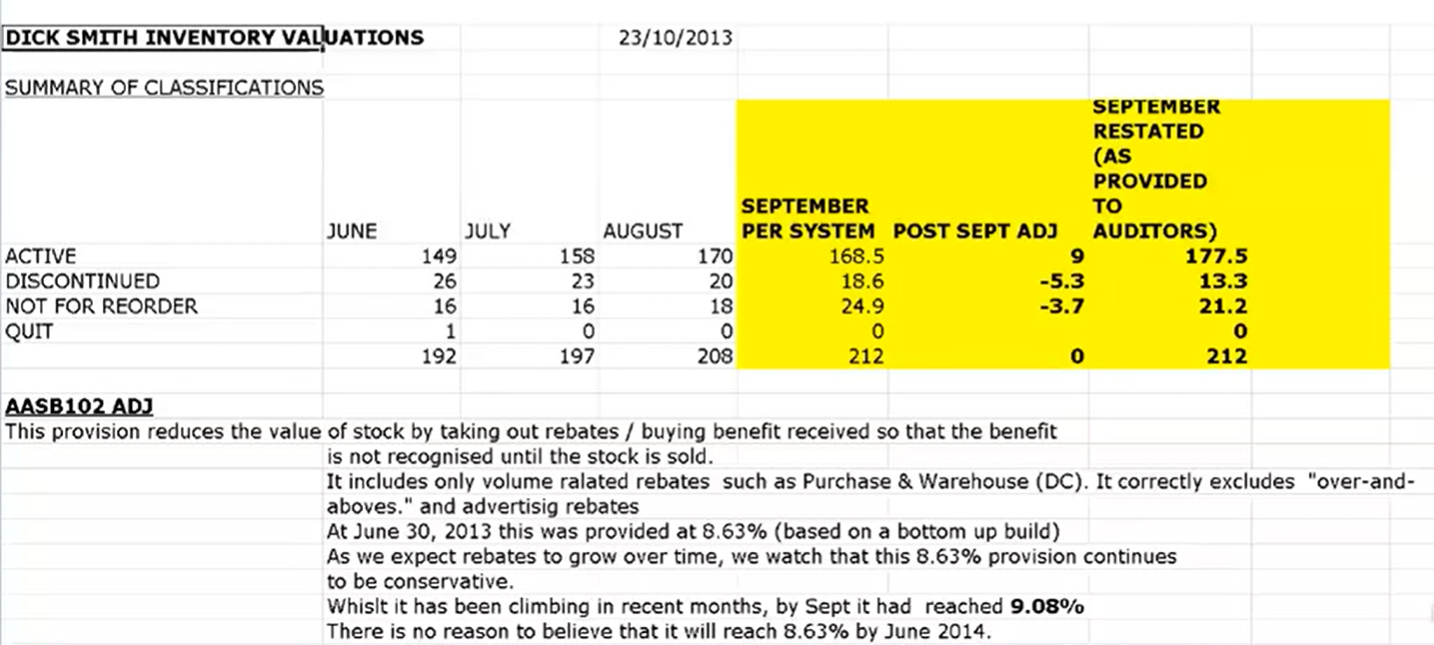

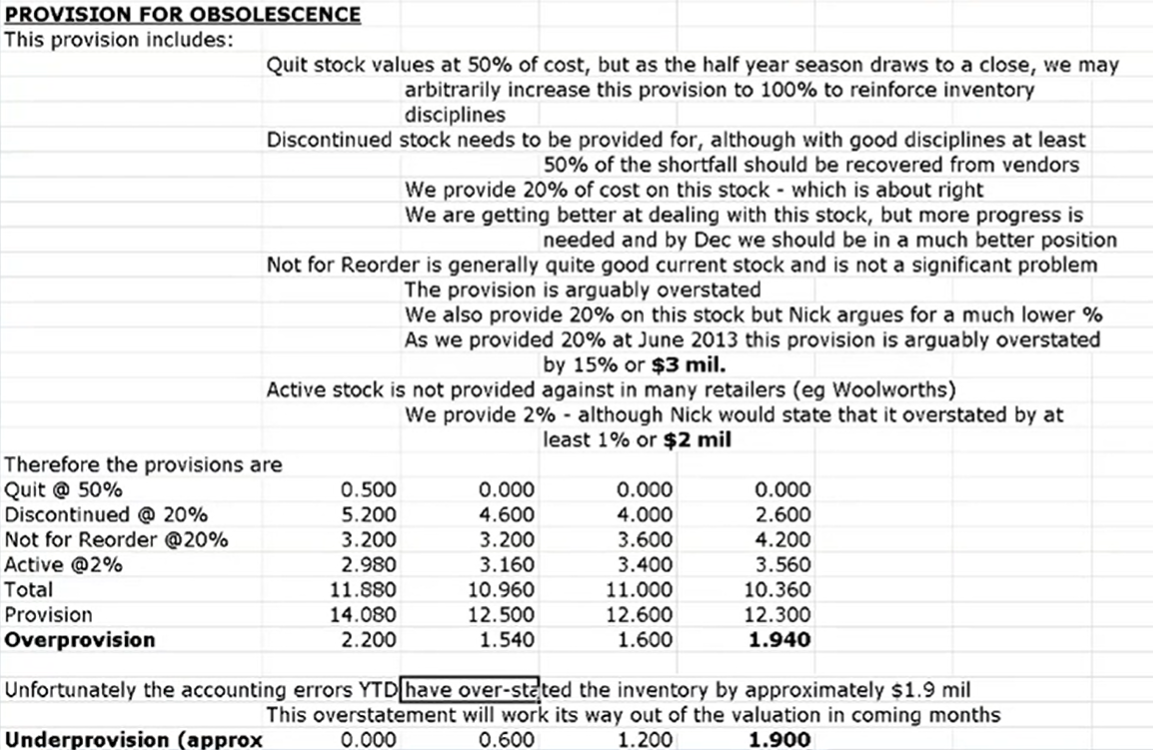

Wavish said he had “no doubt” he had in fact sent it to Abboud, and that he was “very familiar” with the AASB 102 adjustment, which reduces the value of stock according to rebates. He was taken through the provisioning figures, and asked if he could correct the 50% figure for quit stock. The judge instructed him to just answer barristers’ questions. It was put to him that at the time, the four stock categories were Quit, Discontinued, No Reorder, and Active, which he acknowledged. He agreed that he was setting out an obsolescence provisioning methodology in the above email, which applied percentages to each of the four categories. This was the methodology used in the FY13 statements, he confirmed.

Wavish said the 50% figure for Quit stock should be 100%, and said that in due course, that 100% was applied. He said the other category figures as set out in the email were correct, and that he had himself devised the figures. He was then shown a statement from his affidavit.

Barristers asked how the figures were derived, and how price, sales, and margin history were taken into account. Wavish said the 20% provisions were based on a “long experience in retail” and his answer would be “multifaceted”. He said the numbers came from category reviews and that 80-90% of all products in all categories except private label were from global brands. Generally speaking, he said, if there was a problem with the global branded products, they would virtually all give rebates. These products could be written down by up to 50%, he said.

Wavish was asked how he determined the 20% figure should be included in the email for discontinued lines, and he said that it was important that the supplier be required to make the maximum contribution to any costs relating to discontinued lines. According to Wavish, provisions relating to international branded products with proper category management allowed selling at a 50% discount.

He was asked about the 20% figure for No Reorder, and he said it was very similar to Discontinued. He confirmed the figures were based on his judgment and experience. He was asked if the 2% for Active also reflected judgment and experience, and he dubbed it “an exercise in conservatism”. Barristers asked if the provisioning took into account the age of the inventory. He said that for the international branded products and private label products, it did. He was asked if he had prepared a formal, written analysis of price, margin, or history for the email to Abboud, and he said no – the history had been under Woolworths management, which was “awful”.

It was put to Wavish that he responded very quickly to an email from Abboud and included these figures, and he said the figures had been developed over time.

He was asked how the methodology took into account whether the stock was poor quality or slow moving. He said the company would “go where the data was leading”, and that the auditors said the inventory was improving. He said more than 80% of stock was global branded, and that poor quality stock was likely to be sent back to the suppliers. He at one point said retail was “not quite as simple” as barristers believed. He was accused of trying to confuse the court by saying supplier contributions factored into provisioning, and deliberately obfuscating so as not to give a clear answer.

At this point the hearing was interrupted by technical issues with the audio and the Zoom call, forcing a temporary adjournment. The judge determined that he would not force anyone to come to court if they were concerned about social distancing, as Wavish had indicated he was.

The hearing resumed with Wavish agreeing that it was important to have a rigorous system in place to ensure stock was properly categorised, and that the system would need to identify criteria to determine the category into which stock should be placed. However, audio issues again arose. Wavish was allowed to consult his counsel on whether or not he should come to the courtroom in person.

The hearing resumed again with Wavish having removed his headphones to attempt to hear better. He agreed that if stock was properly classified into one of the non-active categories, it would make good sense to have a provision to encourage clearance. He also agreed that if active stock should have been classified into No Reorder, Discontinued, or Quit, then it could create a disincentive to clear stock and thus result in overstocking.

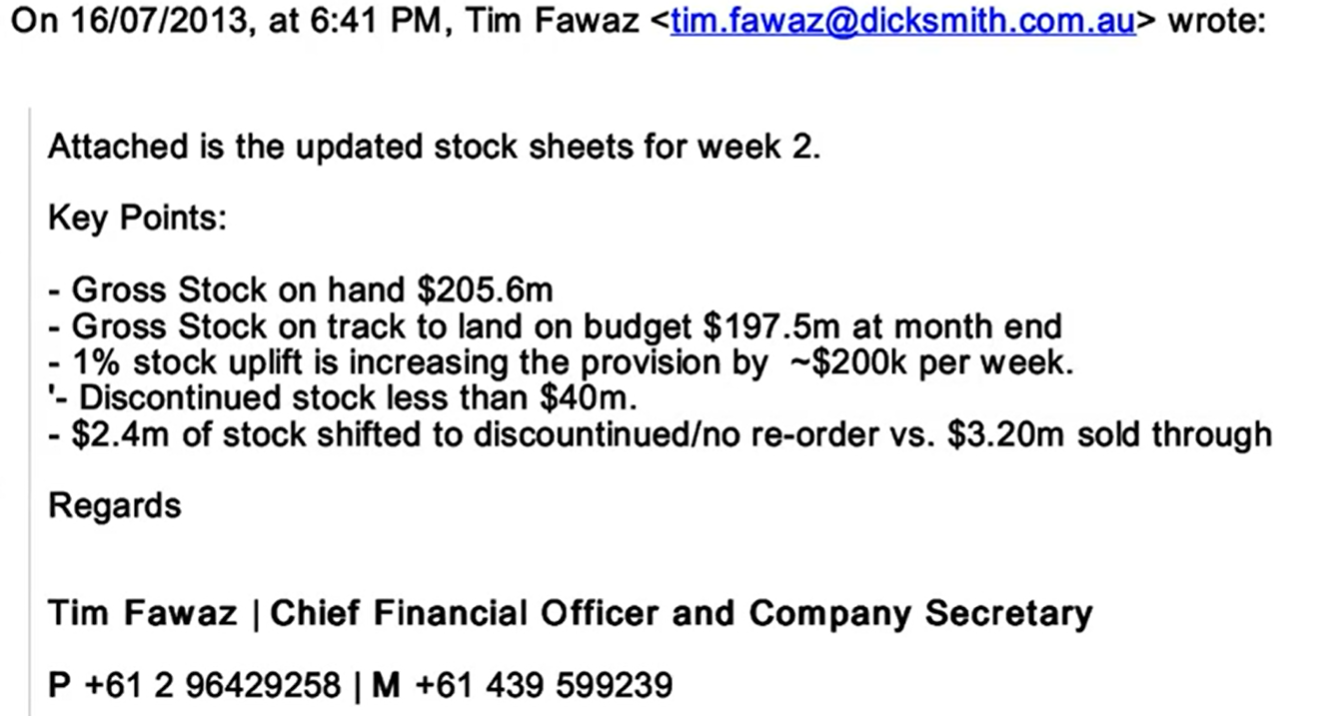

Wavish was then shown an email chain that showed discontinued stock at less than $40m in July 2013.

He said he would have expected the discontinued stock to be in the process of being sold, and that stock was being shifted out of the Active category.

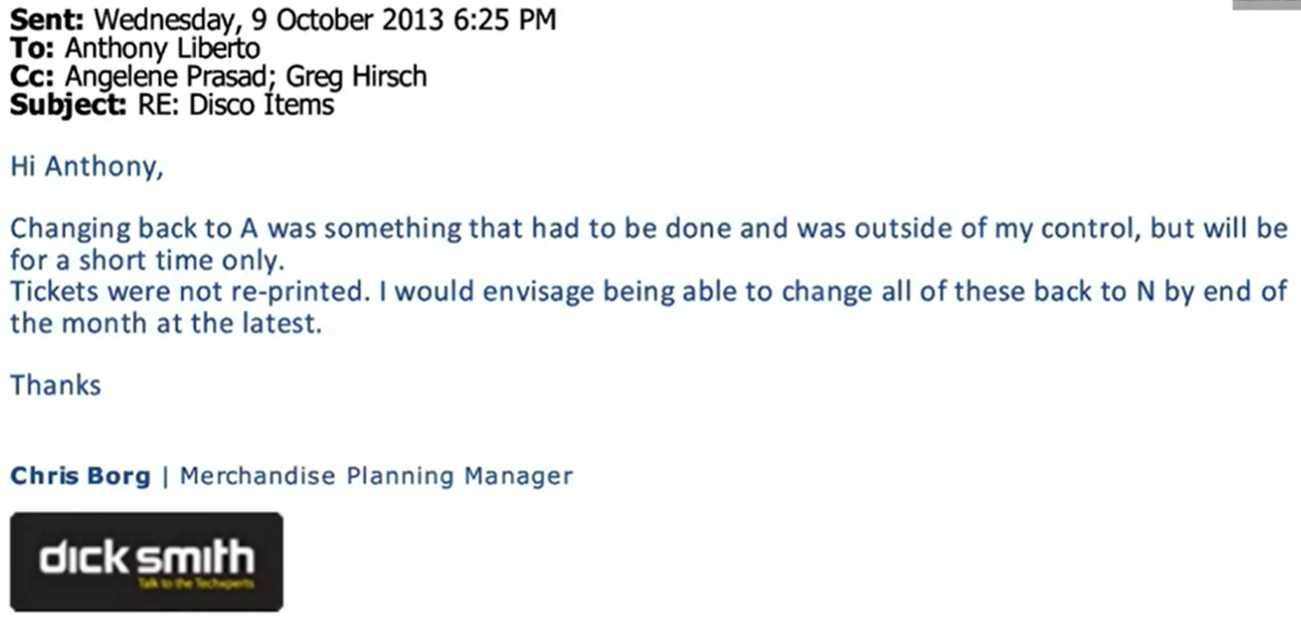

He was shown an email from Chris Borg regarding a freeze on items being moved out of Active status at the time.

He was asked whether, in July 2013, he became aware of the freeze. He said he had not been aware, and said it was “strange” that anyone should write an email like it or implement such a freeze.

“I wasn’t aware of that and I wouldn’t agree with it,” he said, raising the possibility that it was a “grab for power” by Borg. He also said it had not come to his attention until quite recently that Borg had instructed no items be moved into Quit status, or that an additional item status may have been created. He agreed that it was quite an extraordinary thing to say, and opined that Borg was “exceeding his authority”.

He said he had attended meetings with Borg from time to time, but did not recall meeting with him one on one. Wavish was then shown another email from Borg to himself.

He said the meeting described in the email sounded like a “category meeting” and that he did not recall Borg mentioning any of the matters in the previous email at any time.

Another email from Borg to staff a week later described how the provision had been “blown” by items being moved out of Active status without his approval.

Wavish denied knowledge of the email, which he had not received, or the $2.5m in item status movements. He said he did not know any of the people involved and assumed they were all part of the same category.

He was shown a paper he had developed in October 2013 on obsolescence provisioning, referred to as his “one-pager”. He confirmed that there were a number of iterations of this paper.

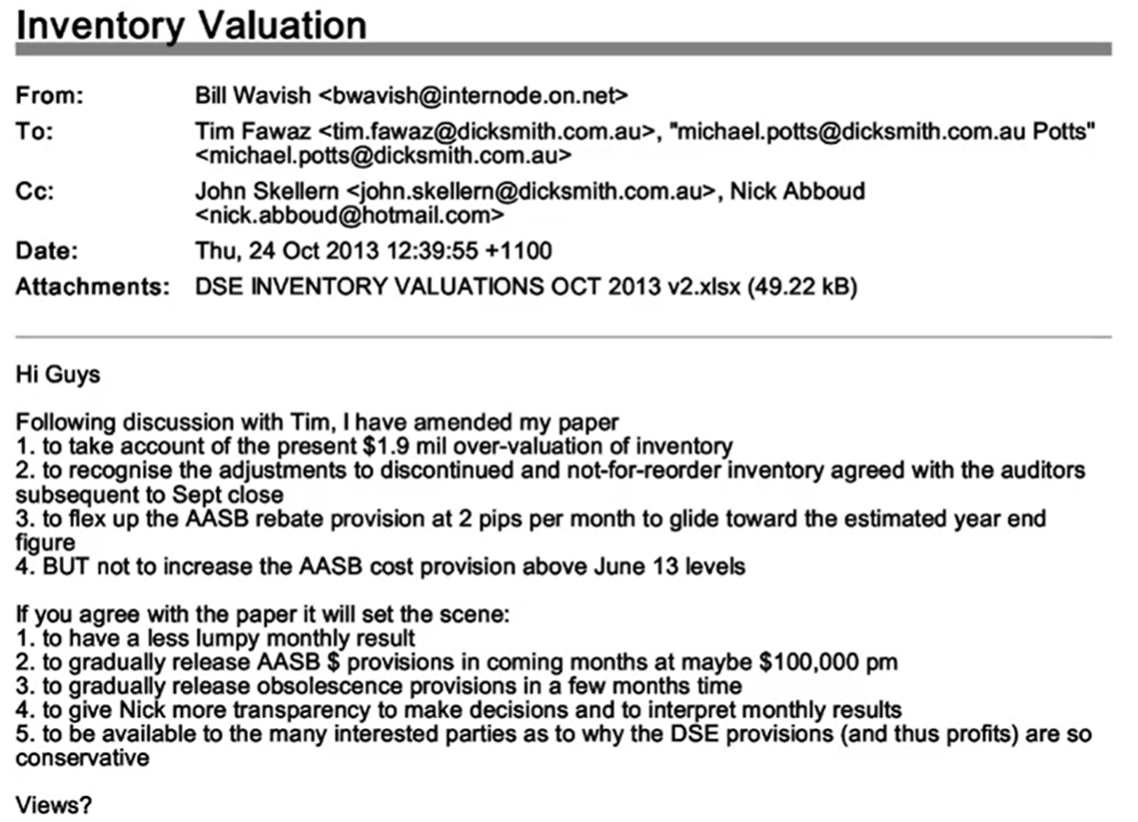

The court then saw another email from himself to John Skellern, copied to Abboud and Michael Potts, regarding inventory provisioning. Attached was an earlier version of his “one-pager”.

Barristers pointed out the lines regarding journal entries looking “mickey mouse” and the auditors “spooking” Dick Smith into an over-reaction. He said he could not recall what the over-reaction was, and was asked about the “mickey mouse” entries. He said he was trying to get to the bottom of them in the email, and did not specifically recall the journal entries in question.

He was then taken to the AASB102 adjustment, and said that the aim was to get everyone on the same page to do their jobs, and to make sure the auditors were in agreement. He said he was aware of Deloitte’s audit of the DY13 statements, and that Deloitte Corporate Finance was compiling an investigating accountant’s report included in the prospectus. He said he was “sort of” aware that Deloitte and Deloitte Corporate Finance were separate, and assumed it was legal.

He was asked if a paragraph regarding rebates reflected his knowledge of AASB102 at the time, and he said yes. He said he did not like the phrase “over and above”, which had “no legal meaning”. Barristers put to him that he was of the view at the time that rebates that were associated with the acquisition of inventory should not be booked to profit until the inventory was sold. He said that this excluded scan rebates, and to say anything else would be “misleading the court”.

He was asked where he got the information from regarding rebates growing over time, and he said he believed he calculated it himself. He said he was pretty sure the 8.63% came from the June 2014 budget.

The court saw an email from Tim Fawaz to Wavish in October 2013, which he said he did not recall.

He said he did not recall the stock reclassification of $9m from Discontinued/No Reorder to Active, or any discussion of the issue with Fawaz, Potts, or Nigel Mills. He also said he did not recall the overvaluation of stock Fawaz mentioned.

He then saw amendments to his “one-pager” attached to the above email.

Barristers asked if this refreshed his memory of the $9m of stock moved from Discontinued and Not For Reorder into Active. He acknowledged it seemed to be a “similar number” but said he still did not recall the issue being raised with him.

He was then shown an email chain involving item reclassification, on which he was not a recipient.

He said Anthony Liberto was a man who “warmed the cockles of his heart” for asking why discontinued SKUs were being changed to Active. He was asked if it came to his attention in October 2013 that hundreds of items were being moved from Discontinued and No Reorder back into Active. His barristers objected, saying he had already been asked and answered this question multiple times, and the plaintiffs’ barristers moved on.

He said the change back to A was not a directive from him. He was asked if he could provide any insight as to why stock would be moved back into Active for a short time only, but his barristers successfully objected on the grounds that it was asking Wavish to speculate on matters of which he said he had no recollection. Instead the plaintiffs’ barristers showed the court an email from Reiko Sun.

Barristers put to Wavish that he could not tell the court of any measures he would have taken to ensure the stock was being shifted appropriately. He said he had not been asked how the $9m adjusted could have occurred, and the barristers acquiesced and asked him; he said it wouldn’t have surprised him if the “hundreds of items” moved were from private label, but would have had they been global brands. He said he would not have felt an urgency to look at the issue until the end of the reporting period.

Barristers put it to Wavish that in October 2013, it would have been important to the 1Q14 results that revenue was correctly booked in September and October 2013. For the purposes of the prospectus, the accuracy of the 1Q14 period was important, he confirmed. Barristers suggested that in October 2013 it would have been important to him that profits were correctly booked in September or October, and he confirmed that July-September 2013 would have been an important one for the prospectus. He said he was paying very detailed attention to the contents of the prospectus at the time, so he would have been looking closely at the balance sheets, though he could not recall single transactions from that time.

He was then shown an email from himself to Fawaz and Potts, with Abboud and Skellern copied in.

He said he did not recall making adjustments to his paper following discussions with Fawaz. He was shown what barristers told him was the final version of his “one pager”, which he disputed was the final version.

He did agree, however, that it was the version presented in his affidavit. He was asked if he recalled adjusting the one-pager to reflect the reclassification of stock into Active, and he said he did not. He was asked if he accepted that this was likely what he did, based on his above email, and he said it was likely. He was then shown another section of his “one pager” dealing with obsolescence provisions.

He was asked if he recalled undertaking calculations that revealed an overprovision of $1.94m, and he said they came out mathematically from the paper. He said he remembered updating the paper and believing it was “very conservative”. He said he did recall the accounting errors that overstated the inventory by approximately $1.9m, and barristers put to him that $9m of stock was reclassified in October 2013 into Active, then related back to September to generate a number of $1.94 million by way of overprovision in a way to net out the accounting errors in the one-pager. His barristers objected, saying it should be made “crystal clear” whether he is being asked if these actions were undertaken intentionally and for a purpose, but the question was allowed.

The plaintiff’s barristers suggested to Wavish that firstly, when he prepared the above version of the one-pager, one of the things he did was to take account of the $9m stock reclassifications. He agreed. They then suggested that the stock was reclassified in October but related back to the September numbers; he said it was related back to “the period to which it was related”. They then suggested that as a consequence, the inventory was overstated by $1.9m.

The court has now adjourned until 10am tomorrow.